Real estate investors rely upon a variety of types information when negotiating for income producing properties - for instance, the desirability of the property's current location and/or any prospective changes in the neighborhood are two common factors. One crucial piece of information that helps investors make their decision is called the capitalization rate (or "cap rate"). The cap rate (expressed as the ratio of the property's net income to its purchase price) allows investors to compare properties by evaluating a rate of return on the investment made in the property. See Step 1 below to calculate the cap rate for your home!

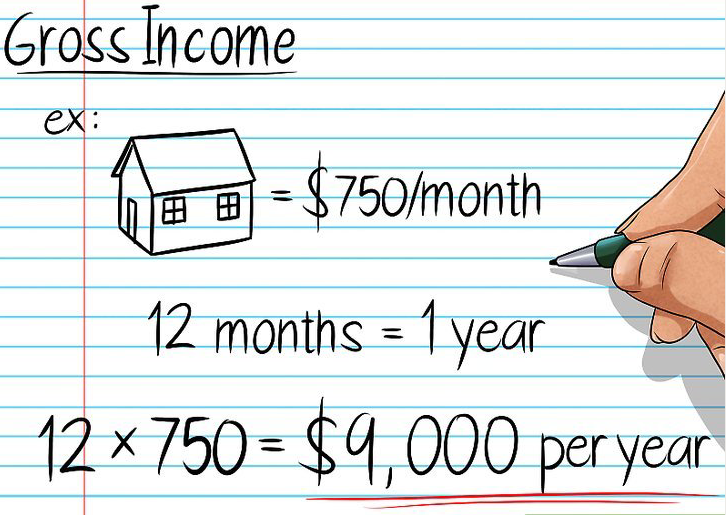

- 1Calculate the yearly gross income of the investment property. The gross income of a piece of investment property will mainly be in terms of rent rolls. In other words, when a real estate investor buys a home, s/he usually makes money from it primarily by renting it out to tenants. However, this isn't the sole possible source of income - miscellaneous income can also accrue from the property in the form of coin operated vending or washing machines, etc.

- For example, let's say that we've just purchased a house we intend to rent to tenants at a rate of $750/month. At this rate, we can expect to make 750 × 12 = $9,000 per year in gross income from the property.

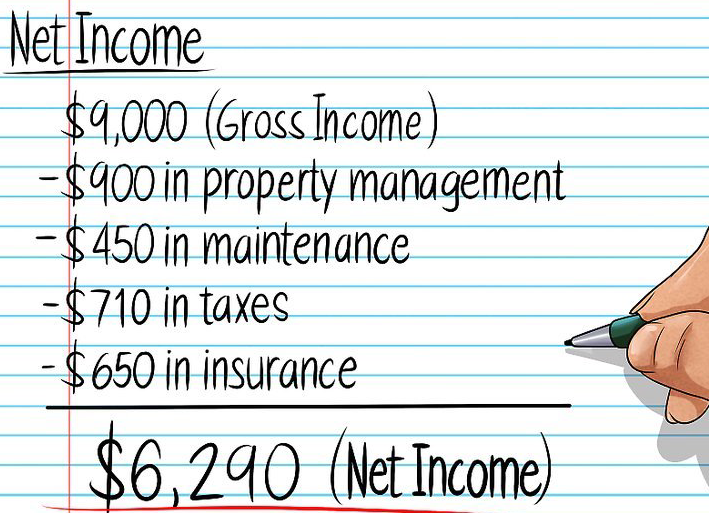

2Subtract the operating expenses associated with the property from the gross income. Any piece of real estate comes with operating costs. Usually, these are in the form of maintenance, insurance, taxes, and property management. Use accurate estimates for these numbers and subtract them from the gross income you found above. This will find the property's net income.

2Subtract the operating expenses associated with the property from the gross income. Any piece of real estate comes with operating costs. Usually, these are in the form of maintenance, insurance, taxes, and property management. Use accurate estimates for these numbers and subtract them from the gross income you found above. This will find the property's net income.- For example, let's say that, after having our rental property appraised, we find that we can expect to pay $900 in property management, $450 in maintenance, $710 in taxes, and $650 in insurance per year for our property. 9,000 - 900 - 450 - 710 - 650 = $6,290, our property's net income.

- Note that the cap rate doesn't account for the property's business expenses - including the purchase costs of the property, mortgage payments, fees, etc. Since these items reflect the investor's standing with the lender and are variable in nature, they adversely affect the neutral comparison that the cap rate is meant to deliver.

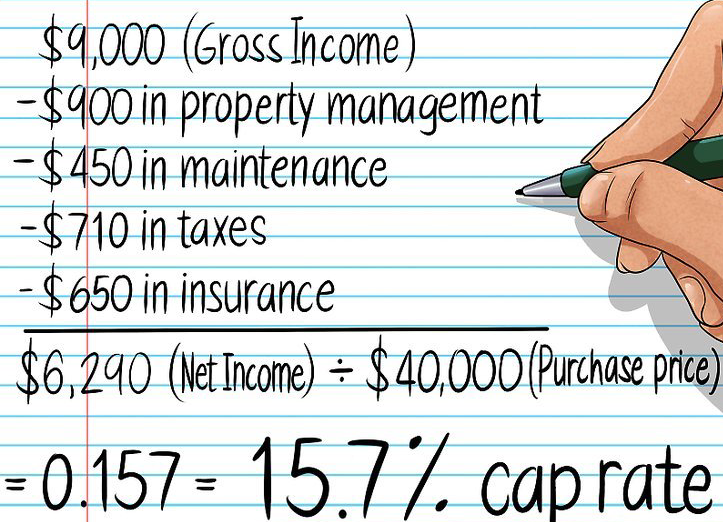

3Divide the net income by the property's purchase price. The cap rate is the ratio between the net income of the property and its original price or capital cost. Cap rate is expressed as a percentage.

3Divide the net income by the property's purchase price. The cap rate is the ratio between the net income of the property and its original price or capital cost. Cap rate is expressed as a percentage.- Let's assume we purchased our property for $40,000. Given this information, we now have everything we need to know to find our cap rate. See below:

- $9000 (gross income)

- -$900 (property management)

- -$450 (maintenance)

- -$710 (taxes)

- -$650 (insurance)

- =$6290 (net income) / $40000 (purchase price) = 0.157 = 15.7% cap rate

1Use cap rates to quickly compare similar investment opportunities. The cap rate basically represents the estimated percent return an investor might make on an all-cash purchase of the property. Because of this, cap rate is good statistic to use when comparing a potential acquisition to other investment opportunities of a similar nature. Cap rates allow quick, rough comparisons of the earning potential of investment properties and can help you narrow down your list of choices.

1Use cap rates to quickly compare similar investment opportunities. The cap rate basically represents the estimated percent return an investor might make on an all-cash purchase of the property. Because of this, cap rate is good statistic to use when comparing a potential acquisition to other investment opportunities of a similar nature. Cap rates allow quick, rough comparisons of the earning potential of investment properties and can help you narrow down your list of choices.- For example, let's say that we're considering buying two pieces of property in the same neighborhood. One has a cap rate of 8%, while the other has a cap rate of 13%. This initial comparison favors the second property - it is expected to generate more money for each dollar you spend on it.

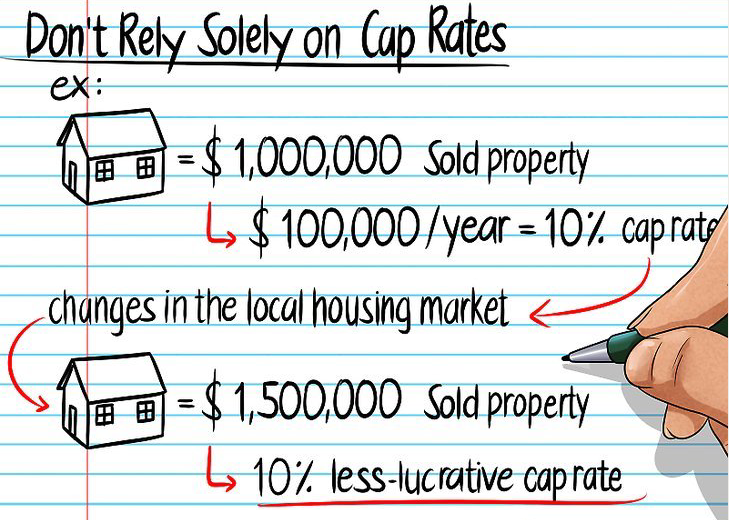

2Don't use cap rate as the sole factor when determining an investment's health.While cap rates offer the opportunity to make quick, easy comparisons between two or more pieces of property, they're far from the only factors you should consider. Real estate investment can be quite tricky - seemingly straightforward investments can be subject to market forces and unforeseen events beyond the scope of a simple cap rate calculation. At the very least, you'll also want to consider the growth potential of your property's income as well as any likely changes in the value of the property itself.- For example, let's say that we buy a piece of property for $1,000,000 and we expect to make $100,000 per year from it - this gives us a cap rate of 10%. If the local housing market changes and the value of the property increases to $1,500,000, suddenly, we have a less-lucrative cap rate of 6.66%. In this case, it may be wise to sell the property and use the profits to make another investment.

3Use the cap rate to justify the income level of the investment property. If you know the cap rate of properties in the area of your investment property, you can use this information to determine how much net income your property will need to generate for the investment to be "worth it". To do this, simply multiply the property's asking price by the cap rate of similar properties in the area to find your "recommended" net income level. Note that this is essentially solving the equation (Net income/Asking price) = cap rate for "net income".

3Use the cap rate to justify the income level of the investment property. If you know the cap rate of properties in the area of your investment property, you can use this information to determine how much net income your property will need to generate for the investment to be "worth it". To do this, simply multiply the property's asking price by the cap rate of similar properties in the area to find your "recommended" net income level. Note that this is essentially solving the equation (Net income/Asking price) = cap rate for "net income".- For example, if we bought a property for $400,000 in an area where most similar properties have about an 8% cap rate, we might find our "recommended" income level by multiplying 400,000 × .08 = $32,000. This represents the amount of net income the property would need to generate per year to get an 8% cap rate, so we would set the rental rates accordingly.